Bitcoin's Path Ahead: Analyzing the Indicators for the Next Bull Run

In-Depth Market Insights and Technical Analysis to Prepare for Bitcoin’s Next Major Move

🌟🌟🌟🌟🌟 Recommendations of ChartScope

Before diving into today’s market analysis, we’d like to highlight a few highly valuable newsletters that offer great insights and information to enhance your financial and investment decisions. These sources cover everything from global events shaping the markets to practical strategies for navigating economic fluctuations. Explore these to stay informed and ahead in your investment journey.

A concise, daily overview of key global events shaping markets and finance.

Expert analysis and insights on macroeconomic trends and policy impacts.

Actionable investment strategies blending technical analysis and market psychology.

Deep dives into crypto markets and blockchain innovations, with a focus on actionable insights.

A curated selection of the latest trends and deals in venture capital and startup ecosystems.

Detailed market context and forecasts to help navigate stock and bond market fluctuations.

Easy-to-understand breakdowns of financial news, investment strategies, and personal finance tips.

Introduction: Bitcoin’s Current Market Landscape

As we approach the final quarter of 2024, the financial world remains captivated by Bitcoin’s performance and potential. This article aims to dissect the current market environment surrounding Bitcoin and provide actionable insights for traders and investors. While the broader stock and crypto markets are undeniably intertwined, we’ll keep the spotlight firmly on Bitcoin, diving into the nuances of its behavior amidst interest rates, inflation, and global market volatility.

Bitcoin’s performance in 2023 was nothing short of extraordinary, posting gains of over 336% in just one year. Compared to other asset classes, Bitcoin has reigned supreme, delivering unmatched returns. However, this performance isn’t merely a result of retail investor enthusiasm; institutional money has made its presence known. Giants like BlackRock and other significant players have entered the arena, giving Bitcoin a level of legitimacy that was once elusive. On-chain data suggests that more and more Bitcoins are leaving centralized broker platforms and moving into long-term storage, which is another bullish signal, as these assets are less likely to be sold off in the short term. This movement of assets away from exchanges has added immense buying pressure, driving up prices even further.

However, the rise of institutional money comes with its own risks. Financial institutions now have considerable leverage over the Bitcoin market. These entities aren’t just investing in Bitcoin for the long haul—they’re also strategically shorting the asset to hedge their positions, manipulating market trends in their favor. This creates a dynamic where Bitcoin’s long-term outlook is promising, but its short-term moves are highly volatile. As institutional money grows, so does its influence, and while that could mean sustained upward momentum in the years to come, investors need to remain vigilant in the face of potential short-term market manipulations.

The Market Environment and Bitcoin’s Role

Before we dive into Bitcoin-specific indicators, it’s important to understand the broader market environment. In 2024, the global financial markets are grappling with a delicate balance of inflation, deflation and interest rates. The U.S. Federal Reserve and other central banks worldwide continue to adjust their policies in response to economic pressures. For Bitcoin, these macroeconomic factors play a significant role in shaping its price movements. Historically seen as a hedge against inflation, Bitcoin is increasingly viewed as a store of value, similar to gold, by both retail and institutional investors.

In 2024, Bitcoin became more accessible to global investors, with financials like BlackRock and Fidelity offering Bitcoin ETFs, creating a bridge between traditional finance and crypto. This influx of capital has had a profound effect on Bitcoin’s price action. On-chain data reveals a continuous trend where Bitcoins are moving off exchanges, signaling that long-term holders (often referred to as "whales") are preparing for a prolonged bull run. This reduction in supply is a positive indicator of Bitcoin’s price as fewer coins are available for immediate sale, applying upward pressure on the market.

Short-Term vs. Long-Term Dynamics

While Bitcoin’s long-term outlook appears bullish, fueled by institutional adoption and a growing user base, investors must remain cautious. Institutions aren’t simply investing in Bitcoin; they are also shorting it, creating a dual-edged sword. These financial institutions now hold significant power in determining Bitcoin’s short-term price action. As they accumulate more Bitcoin, they also have the leverage to manipulate prices, often using market psychology to shake out retail investors during downturns. This results in significant price volatility, especially during periods of high leverage and low liquidity. While Bitcoin’s long-term fundamentals are solid, short-term traders should brace themselves for continued volatility.

For long-term holders, the institutional presence is ultimately a positive sign. It shows confidence in Bitcoin’s future, and large-scale investments generally indicate a sustained upward trajectory. However, in the short-term, institutions are playing a different game, using their influence to create opportunities for strategic gains. Understanding these dynamics is crucial for navigating Bitcoin’s volatile landscape.

Technical Indicators to Watch: OBV, Fibonacci, Pi Cycle, and More

Technical analysis provides a wealth of information when trying to predict Bitcoin’s future price action. In this section, we’ll break down some of the most widely used indicators and explain what they are telling us about Bitcoin’s potential direction in the coming months.

1.1 OBV (On-Balance Volume) Indicator

What it is: A momentum indicator that measures buying and selling pressure by tracking volume flow.

Why it’s useful: OBV helps confirm price trends. If the OBV is rising along with the price, it indicates strong buying momentum, while a falling OBV with a rising price could indicate a potential reversal or weakness.

The OBV indicator is one of the key tools used to measure buying and selling pressure in the market. It tracks cumulative volume, indicating whether the broader market is accumulating or distributing an asset. Over the past few days, the OBV has been signaling a positive shift in Bitcoin’s momentum. This suggests that more market participants are buying than selling, which is often a precursor to a price breakout.

In the case of Bitcoin, the OBV has been steadily rising, indicating that accumulation is taking place. This means that the "smart money" is positioning itself for the next leg up. Historically, when OBV shows a sustained upward trend, Bitcoin follows with a significant price increase. If the OBV continues to rise, we could see Bitcoin break through its current resistance levels and head toward new all-time highs.

1.2 + Fibonacci Retracements

What it is: A tool used in technical analysis to identify potential reversal levels by measuring key ratios from a trend (often 61.8%, 38.2%, and 23.6%).

Why it’s useful: Traders use Fibonacci levels to identify areas where price might reverse or pull back during a trend. The most common levels are 61.8% and 78.6%, which are often used to set targets or stop-losses.

Fibonacci retracement levels are a cornerstone of technical analysis and are frequently used by traders to identify potential support and resistance zones. In Bitcoin’s case, the 61.8% and 78.1% retracement levels are particularly important. Based on the recent price action, Bitcoin could test these levels in the short term.

Should Bitcoin reach the 61.8% Fibonacci level, we’ll be watching for a breakout or a rejection. If the price breaks through this level, it’s likely that we’ll see Bitcoin test the upper 78.1% retracement. However, a rejection at these levels could signal a short-term pullback before resuming the uptrend.

3. Pi Cycle Indicator

What it is: A long-term indicator that uses moving averages to identify market cycles and major trend reversals.

Why it’s useful: This indicator has historically predicted Bitcoin market tops with accuracy. It’s especially useful for identifying long-term price cycles and signaling when a significant price correction might occur.

The Pi Cycle Indicator has been one of the most reliable tools for predicting Bitcoin’s major market cycles. Since its inception, the indicator has accurately marked both tops and bottoms in Bitcoin’s price. As of now, the Pi Cycle suggests that we are in a phase similar to the 2018-2020 period, where Bitcoin experienced a slow grind upward, followed by a sharp correction.

The Pi Cycle Indicator’s current reading indicates that Bitcoin could be heading for a slow bleed until the Federal Reserve lowers interest rates to 0%. Although the market recently broke out of its previous range, this move wasn’t as impulsive as many expected. The indicator warns that, despite the recent upward price action, Bitcoin may still be subject to downward pressure in the months ahead.

4. MFI+ (Money Flow Index Plus) Indicator

What it is: Similar to the RSI, but it also includes volume data to assess whether an asset is overbought or oversold.

Why it’s useful: MFI+ gives traders an idea of buying or selling pressure. When the index is above 80, it suggests overbought conditions, while a value below 30 indicates oversold conditions, signaling a potential reversal.

The MFI+ is another powerful tool for analyzing Bitcoin’s momentum. Similar to the RSI, it measures overbought and oversold conditions but with additional insights into money flow. The MFI+ has consistently been accurate in identifying key reversal points in Bitcoin’s price.

In each bull run since 2012, Bitcoin has entered overbought territory on the MFI+ when it crossed above 80 on the monthly chart. Currently, the MFI+ is approaching these levels again, which historically has been a warning signal for traders to be cautious. When Bitcoin hit these levels in 2021, it marked the top of the bull market, and the subsequent correction caught many traders off-guard.

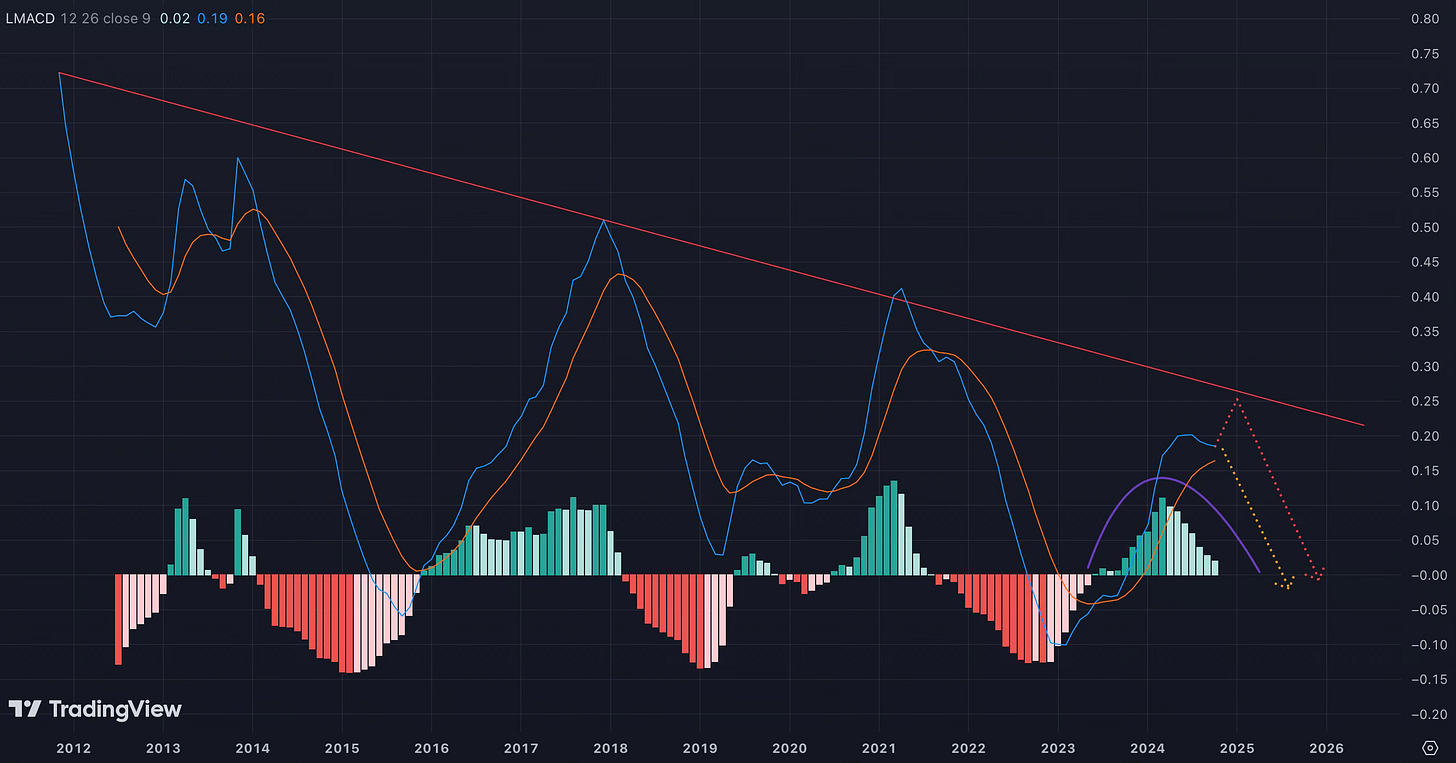

5. LMACD (Logarithmic Moving Average Convergence Divergence)

What it is: A variation of the traditional MACD that applies to logarithmic price scales, which is better suited for assets like Bitcoin with large price ranges.

Why it’s useful: LMACD shows the relationship between two moving averages and helps identify trend strength and potential reversals. It’s particularly useful in long-term analysis because it smooths out price movements in highly volatile assets like crypto.

The LMACD indicator is a modified version of the traditional MACD, adapted for assets like Bitcoin that have exponential growth patterns. It helps traders identify changes in momentum and potential trend reversals. Since 2012, the LMACD has shown a consistent pattern of lower highs, which is a sign that Bitcoin’s volatility is decreasing as the asset matures.

While Bitcoin is still volatile compared to traditional assets, the LMACD suggests that it is becoming more stable over time. This stabilization will likely continue as institutional adoption grows, making Bitcoin less susceptible to wild price swings and more like a store of value. The LMACD also shows that Bitcoin’s current momentum is weakening, which could be a signal for an upcoming correction or consolidation.

6. Hash Ribbon Indicator

What it is: A Bitcoin-specific indicator based on mining difficulty and hash rates, showing when miners are capitulating (selling off) or recovering.

Why it’s useful: This indicator often signals a bottom when miners give up and stop mining, which can be followed by a price recovery. It’s a great tool for catching long-term buy signals in Bitcoin.

The Hash Ribbon indicator is another important tool for Bitcoin traders. It uses the computational power of the Bitcoin network to gauge miner behavior, often signaling when miners are in a capitulation phase or accumulating more Bitcoin. In June and July of 2024, the Hash Ribbon flashed a buy signal, which has historically preceded major upward moves in Bitcoin’s price.

Currently, the Hash Ribbon is indicating a healthy network, which supports the idea of continued bullish momentum in the near term. However, as with all indicators, it’s important to use it in conjunction with other metrics to get a full picture of the market.

7. RSI and Stochastic RSI

RSI

What it is: A momentum indicator that measures the speed and change of price movements, ranging from 0 to 100.

Why it’s useful: Traders use the RSI to identify overbought (above 70) or oversold (below 30) conditions. An overbought condition may indicate a potential downward reversal, while an oversold condition suggests an upward reversal could be imminent.

Stoch RSI

What it is: A more sensitive version of the RSI that measures the current RSI relative to its own high and low range over a specific period.

Why it’s useful: It helps traders spot potential turning points in price action, particularly in ranging or less volatile markets. A value above 80 suggests overbought conditions, while a value below 20 indicates oversold conditions.

The RSI (Relative Strength Index) is approaching overbought levels on the monthly chart, suggesting that Bitcoin’s current rally may be nearing its end. Historically, when Bitcoin’s RSI crosses above 80, a correction usually follows.

The Stochastic RSI, which is a more sensitive version of the RSI, is currently sitting around 50 on the monthly chart, signaling that Bitcoin could still have room to run before a more significant pullback occurs.

Both indicators suggest that we are in the late stages of this rally, with the downside risk now outweighing the potential for further upside. This is a key point for traders to watch, as it may signal the end of the current bull run and the start of a new consolidation phase.

Bitcoin’s Future: What to Expect

Keep reading with a 7-day free trial

Subscribe to ChartScope: Actionable Market Insights & Data Analysis to keep reading this post and get 7 days of free access to the full post archives.