FOMC, Fear & Falling Wedges: Why March Might Be the Best Buying Opportunity of 2025

Rates remain stable, inflation is dropping, and markets are stuck between fear and greed. Here’s why this uncertainty could be your biggest advantage.

Intro: Welcome Back After a Wild FOMC Day!

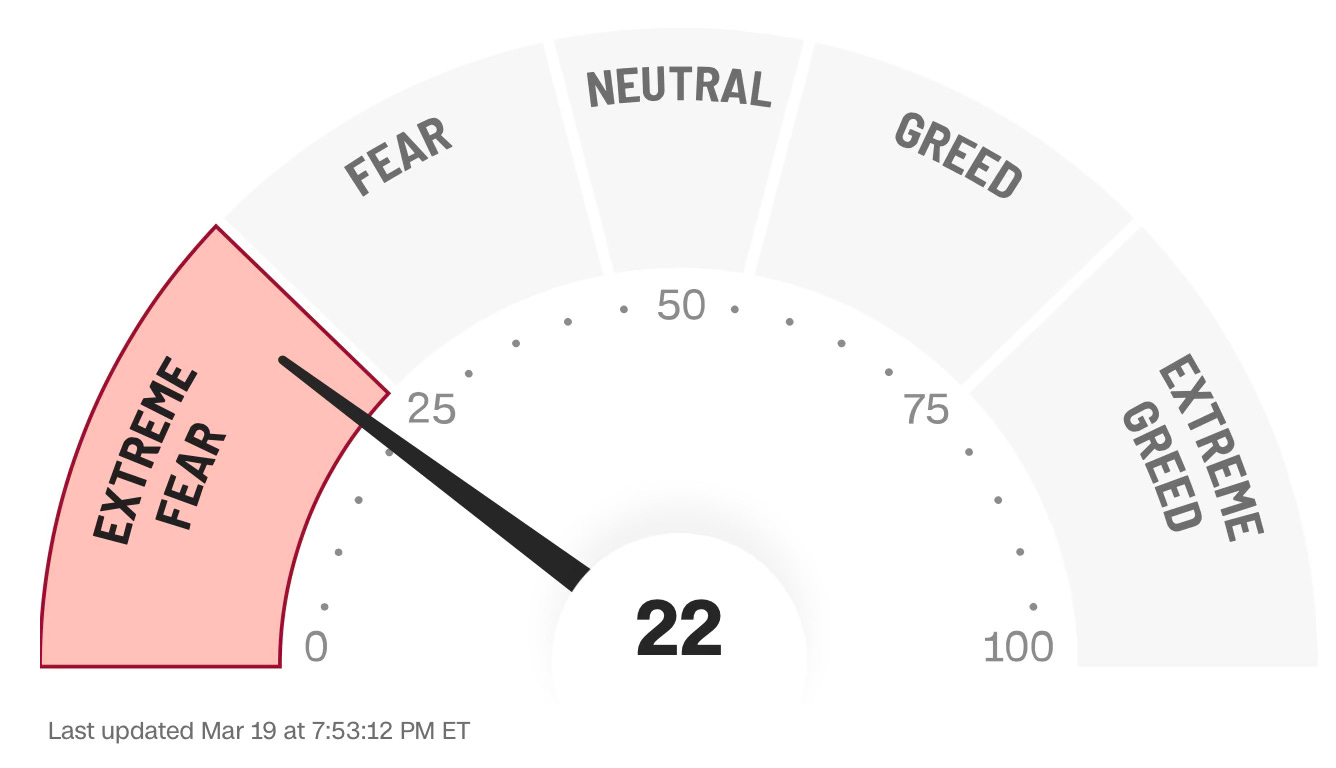

Welcome back to ChartScope! Today’s FOMC decision kept rates steady, but the market’s reaction was anything but calm. The Fear & Greed Index for the S&P 500 sits at 22—deep in Extreme Fear territory. Investors are feeling nervous.

Geopolitical tensions and trade conflicts have weighed on sentiment for weeks, and now the market seems paralyzed, unsure where to head next. But when uncertainty peaks, opportunities usually follow.

We’re seeing a healthy correction play out. Corrections like this aren’t necessarily bad—they often lay the groundwork for the next leg up. Some stocks are down 30-50%, and major indexes have dropped around 10%. Historically, 75% of corrections like this lead to strong rebounds.

So, is this the bottom? Or will we see another flush before the rally? Let’s dive in.

Section 1: Inflation – Reading Between the Lines with Truflation

Before we talk strategy, we need to understand inflation—the real data, not just the government numbers. That’s where Truflation comes in. It provides daily, real-time inflation data, unlike official reports that are often outdated or revised.

Currently, Truflation shows inflation at 1.72% and trending lower. We saw a notable dip in February, and it’s continued into March. If this downtrend holds, we could see official CPI numbers drop sharply by April.

What does that mean for markets? Medium-term bullishness. Lower inflation takes the pressure off the Fed, increasing the chances for rate cuts and liquidity injections. And that’s the oxygen altcoins and small caps desperately need.

More on that in the FOMC section next.

Section 2: The FOMC Statement – QT Slows, QE on the Horizon?

Yesterday’s FOMC statement was a game-changer. The Fed left rates unchanged at 4.25 - 4.5%, but they’re slowing down quantitative tightening (QT) big time. Starting in April, they’ll reduce the monthly runoff of U.S. Treasuries from $25 billion to $5 billion. Mortgage-backed securities (MBS) rolloffs stay at $35 billion, but we expect adjustments there soon, too.

Translation? The Fed is taking its foot off the gas when it comes to balance sheet reductions. For us, that signals QE (Quantitative Easing) could return sooner than many expect.

Why does that matter? Over the past two years, altcoins, small caps, and growth stocks have been crushed by liquidity withdrawal. If the Fed eases up and liquidity returns, these asset classes could explode higher.

Section 3: S&P 500 & Nasdaq – Wobbly but Watchful

Both the S&P 500 ( $SPX ) and Nasdaq 100 ( QQQ 0.00%↑ ) broke down from their rising wedges—not a bullish sign. Right now, they’re testing key EMA bands, and unless we see daily closes back above these levels, there’s still a risk of more downside.

Also, options expiration hits tomorrow, which tends to ramp up volatility. We remain cautiously bearish through mid-next week. But this is precisely the time we at ChartScope start planning our entries.

Bottom line: The correction isn’t over, but the bottom may be closer than people think.

Section 4: Roundhill Magnificent Seven ETF – Big Tech Is Primed for a Rebound

Want to know where the big players are headed? Look at the Roundhill Magnificent Seven ETF, which tracks Apple ( AAPL 0.00%↑ ) , Nvidia ( NVDA 0.00%↑ ) , Alphabet ( GOOGL 0.00%↑ ) , Meta ( META 0.00%↑ ) , Amazon ( AMZN 0.00%↑ ) , Tesla ( TSLA 0.00%↑ ) , and Microsoft ( MSFT 0.00%↑ ) . Right now, they’re all sitting in oversold zones.

Our Jewel Buy Indicator just triggered on the daily charts. It’s not confirmed on higher timeframes yet, but it’s often the first sign of a bottom. Plus, the ETF just tagged the 61.8% Fibonacci retracement, which is a classic reversal level.

Bottom line: Big Tech looks ready to bounce mid-next week.

Section 5: Tesla – Controversy Creates Opportunity

Tesla ( TSLA 0.00%↑ ) has taken a beating in the last couple of months. It’s not just earnings concerns—Elon Musk’s alignment with Donald Trump has polarized investors, especially on the left.

That said, Tesla’s delivery numbers outside of China remain strong, and they’re making progress on CyberCab testing and FSD (Full Self-Driving) approval in California and other states.

Technically, we’re retesting a major trendline from above. The bullish wedge we were watching broke down, but we’ve stuck to our DCA strategy (dollar-cost averaging). Historically, April is Tesla’s third-best month, after December and January.

Bottom line: Tesla is still a high-risk, high-reward long.

Section 6: AMD – The Sleeping Giant of Tech

AMD ( AMD 0.00%↑ ) continues to be a retail favorite. While Nvidia dominates the headlines, AMD has been consolidating for nearly a year. It’s been stuck inside a falling wedge, which typically breaks to the upside.

If we get one more dip, it could complete a parallel channel—setting up a breakout with a target near $220.

Patience is key here. The setup looks explosive, but we might need to see that final shakeout first.

Section 7: MSTR – The Bitcoin Proxy Prepares for Liftoff

MicroStrategy ( MSTR 0.00%↑ ) is our crypto proxy of choice. After correcting since late November, it’s showing bullish signs again. The falling wedge targets $517, and we saw the first breakout attempt today.

We expect sideways action through mid-next week, but after that? We’re bullish.

Section 8: Bitcoin – One Last Dip Before Liftoff?

Bitcoin broke down from its previous falling wedge, similar to the major indices. But now, a new falling wedge is forming—and it looks close to completion.

We could see one more dip to $72,000, but after that, we’re looking at new all-time highs. After March 25, 2025, we expect a big move-up. Short-term, our target is $114,000. Longer-term? We’re sticking with $200,000 to $260,000, supported by the Pi Cycle Top and other on-chain data.

🔔 Conclusion: Embrace the Fear—Opportunities Are Everywhere

Markets are nervous. Fear is high. But history shows that the best buying opportunities come when sentiment is at its worst.

With inflation trending lower, the Fed easing off QT, and oversold conditions across equities and crypto, we’re staring at a potential once-in-a-year entry point. Whether it’s Big Tech, altcoins, or small caps, the next few weeks could be a launchpad for major upside.

We’re not saying it’s a straight line up—there may still be one last shakeout. But those who plan ahead and act decisively are usually the ones telling the success stories later.

👉 Key takeaway: March may be the best buying opportunity of 2025. Are you ready?

ChartScope Publication Disclaimer

This article reflects the personal viewpoints and analyses of the author at the time of publication, which are subject to alteration without prior notification. The author has endeavored to ensure the precision of the information, data, and charts presented in this report, yet cannot affirm their absolute accuracy.

The investment perspectives, evaluations of securities, risk considerations, and timelines delineated herein are purely those of the author and should not be construed as personalized financial advice. The content within this publication serves informational purposes only and does not amount to investment advice. Any references to specific securities, through mention, discussion, or analysis, do not constitute encouragement or advice to buy, sell, or hold such securities.

It is incumbent upon each investor to perform their diligent research and comprehend the risks involved with the information provided. The material included in this document does not imply, nor should it be interpreted as, an offer or a plea for advisory services. Before making any investment decisions, readers are advised to seek guidance from a duly registered financial advisor or certified financial planner.

Agree with your points on Tesla. The only thing the protesters achieved while burning Tesla stock is rebalance the supply and demand metrics in Elons favour.