Market Update: Bitcoin's Next Move & Bullish Stock Setups for 2025

Navigating Market Trends, Key Chart Setups, and Strategic Insights

Dear Subscribers and Market Enthusiasts,

We hope you’re having a fantastic start to the year! The financial markets have already shown plenty of volatility, offering both risks and incredible opportunities. In today’s issue, we’re diving deep into Bitcoin’s current range-bound action and what it could mean for the coming months. Additionally, we’ll analyze key stock setups that are showing strong bullish potential. If you’re looking for insights on Tesla, Alibaba, BIDU, and AMD, you’re in the right place.

Stay tuned—there might be a few surprises in here that will catch your attention!

Bitcoin: Range-Bound But Poised for a Major Move

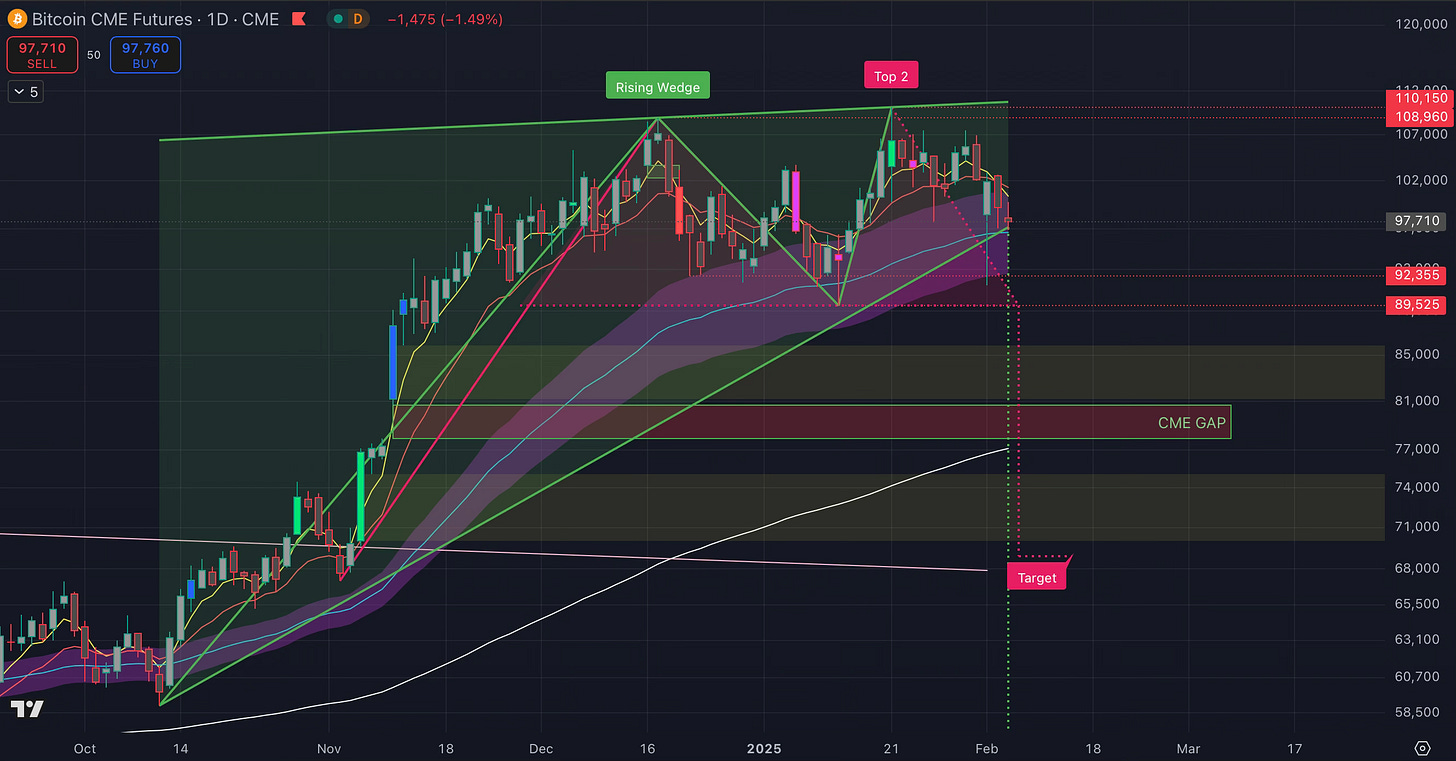

Since December 2024, Bitcoin has been caught in a tight range between $90,000 and $110,000. This sideways movement has been frustrating for traders, as the market lacks a clear trend. Every breakout attempt has been swiftly rejected, keeping Bitcoin in a choppy, indecisive state.

The situation is further complicated by the broader cryptocurrency market. Altcoins, including Ethereum, have been on a steady decline for the past two months, adding to the overall market uncertainty. This makes it a difficult time for those heavily invested in alternative coins, as Bitcoin’s inability to establish a strong trend has weighed down sentiment across the board.

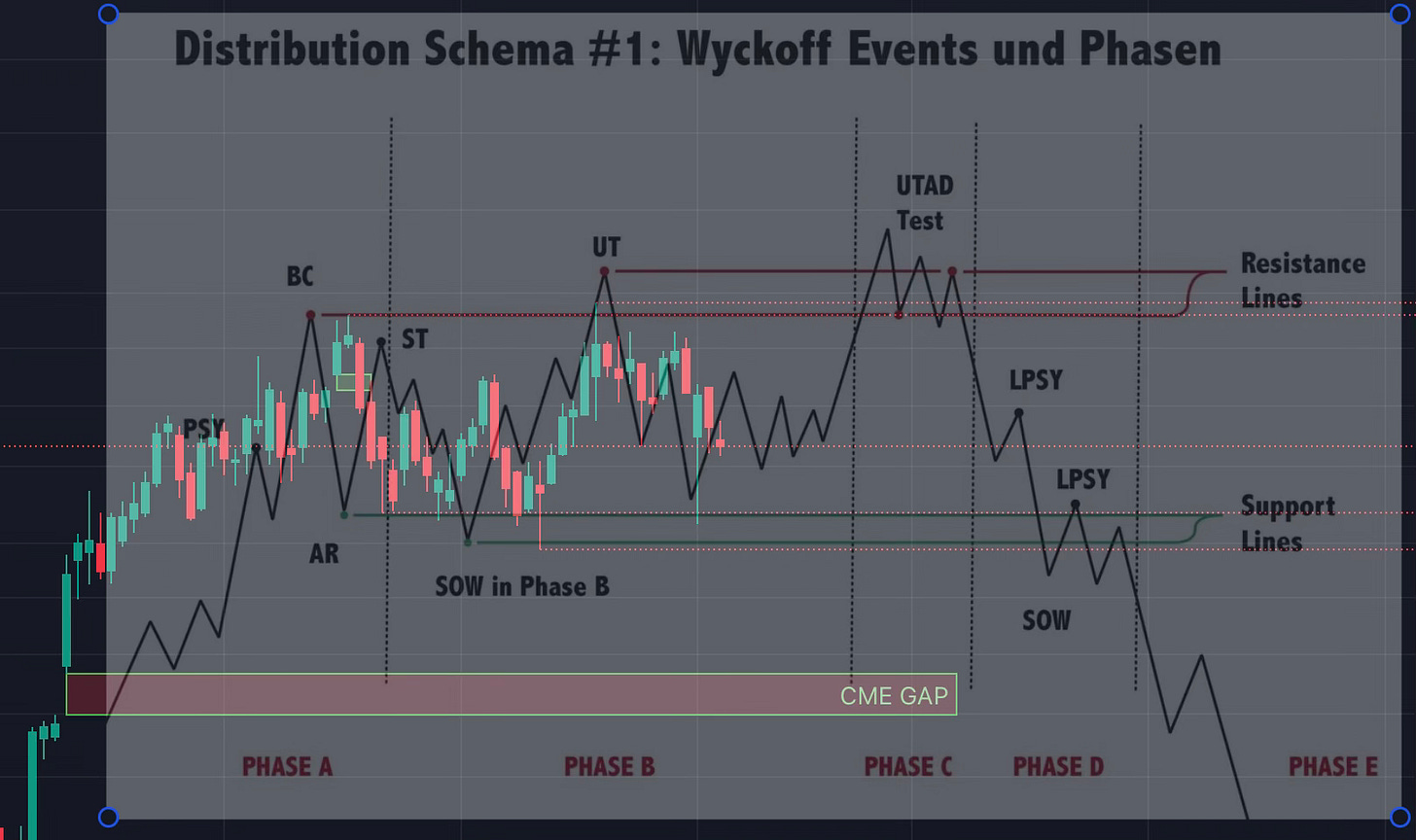

However, there is a silver lining. This consolidation phase is allowing key indicators to reset, potentially setting the stage for a significant move in the coming months. One critical pattern we’re watching is the formation of a bearish rising wedge. If Bitcoin remains in this pattern for too long, we could be witnessing a Wyckoff Distribution, which suggests that the market has already topped out. In this scenario, we might see one final pump into the $110,000-$120,000 range before a sharp drop.

On the other hand, if Bitcoin breaks down quickly into the $80,000 range, this could provide the necessary liquidity and strength to fuel a massive rally toward $160,000 later in the year. Given the current price action, we favor a fast shakeout to reset the market structure before a long-term bullish continuation in 2025.

For now, traders should remain cautious but ready to react swiftly. The next few weeks will be crucial in determining Bitcoin’s trajectory.

Stock Market Focus: Tesla, Alibaba, BIDU, and AMD

Tesla ( TSLA 0.00%↑ ) – A Bullish Breakout in the Making?

Tesla has been one of the most resilient stocks of 2024 after a long period of consolidation. For months, it struggled to find direction, but since December, we’ve seen the emergence of a strong bullish pattern. The current setup indicates a potential move toward $510-$650 on the daily chart.

A key factor to watch is whether Tesla can maintain its support levels through February 21. If this support holds, it strengthens our bullish outlook, and we could see a significant breakout. To capitalize on this opportunity, we’ve positioned ourselves with a call option untill 2026, anticipating a substantial upside move.

Investors should keep an eye on volume and momentum indicators—if buying pressure increases, Tesla could be one of the top-performing stocks of the year.

Alibaba ( BABA 0.00%↑ ) – Still Undervalued and Ready to Surge?

Alibaba has already broken out in recent weeks, as we’ve highlighted multiple times. Despite this, we continue to maintain a bullish stance on the stock.

Several catalysts support our optimism. First, Alibaba’s new AI chatbot could be a game-changer for the company, enhancing its competitive edge in the artificial intelligence sector. Second, the macroeconomic environment in China is improving, with policy shifts favoring economic expansion in the next years. Additionally, Alibaba remains significantly undervalued compared to its long-term potential.

Based on our analysis, we see Alibaba trading between $160-$220 this year. Investors looking for exposure to the Chinese tech sector should strongly consider adding BABA to their watchlist.

Baidu ( BIDU 0.00%↑ ) – A Hidden Gem with Breakout Potential

Baidu is our second major China-based play for 2025. Unlike Alibaba, BIDU has not yet broken out, which presents an even greater opportunity.

From a technical perspective, BIDU is currently trading within a weekly falling wedge. Historically, this pattern has led to strong upside moves once resistance is broken. Should BIDU confirm a breakout, we could see the stock climbing toward $180-$250 over the next few months.

For traders looking for high-reward opportunities, BIDU may offer one of the best setups in the current market.

AMD (Advanced Micro Devices) – The Underdog Ready to Run?

AMD 0.00%↑ has faced a tough battle against NVIDIA ( NVDA 0.00%↑ ), which dominates 95% of the AI chip market. Over the past year, this competition has placed downward pressure on AMD’s stock, leading to a challenging trading environment.

We previously entered call options too early, but recent price action has given us a new entry opportunity. Last week, we took a position in a $170 call option expiring in January 2026. The technical setup remains promising—AMD is deeply oversold on the weekly chart, and a well-defined falling wedge has formed.

A crucial support zone lies between $95-$105. If AMD can hold this range and buyers step in, we could see a strong reversal, potentially pushing the stock toward $230 by year-end.

Additional Stocks on Our Watchlist

Beyond these primary picks, several other stocks have developed strong weekly falling wedge patterns. These include NIO ( NIO 0.00%↑ ) , Nike ( NKE 0.00%↑ ), and JD.com ( JD 0.00%↑ ) and more. We plan to analyze these in more detail in an upcoming post.

Final Thoughts & What’s Next?

The financial markets are at a critical juncture. Whether it's Bitcoin gearing up for a major move or stocks like Tesla and Alibaba showing strong bullish setups, opportunities abound for those who stay informed and act decisively.

Over the coming weeks, we’ll continue tracking key price levels and market developments to provide you with timely updates. If you found this analysis helpful, let us know which asset you’re most excited about in the comments!

We appreciate your continued support and look forward to bringing you even more valuable insights in our next update. Stay sharp, stay focused, and let’s navigate this market together!

Best regards,

Chartscope

ChartScope Publication Disclaimer

This article reflects the personal viewpoints and analyses of the author at the time of publication, which are subject to alteration without prior notification. The author has endeavored to ensure the precision of the information, data, and charts presented in this report, yet cannot affirm their absolute accuracy.

The investment perspectives, evaluations of securities, risk considerations, and timelines delineated herein are purely those of the author and should not be construed as personalized financial advice. The content within this publication serves informational purposes only and does not amount to investment advice. Any references to specific securities, through mention, discussion, or analysis, do not constitute encouragement or advice to buy, sell, or hold such securities.

It is incumbent upon each investor to perform their diligent research and comprehend the risks involved with the information provided. The material included in this document does not imply, nor should it be interpreted as, an offer or a plea for advisory services. Before making any investment decisions, readers are advised to seek guidance from a duly registered financial advisor or certified financial planner.